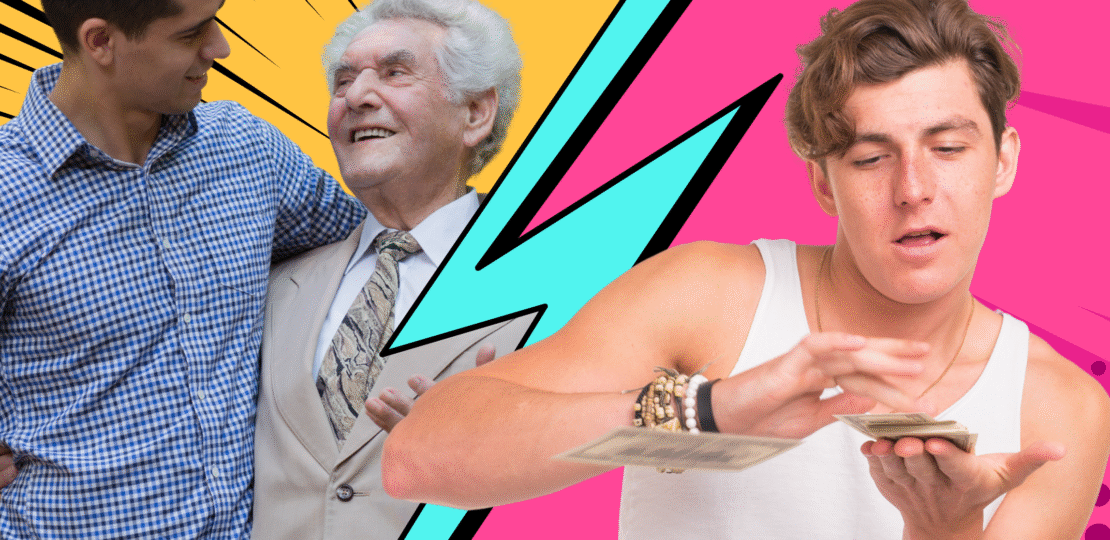

Looking Rich vs Being Rich: The Big Illusion

September 13, 2025 | by Nas Digital Growth

Introduction – Why Appearances Can Deceive

Looking rich vs being rich is one of the most important financial lessons you will ever learn. Scroll through Instagram or TikTok and you’ll see luxury cars, designer clothes, and exotic holidays. At first glance, it feels like wealth. But in reality, most of it is funded by loans, credit cards, or salaries stretched to breaking point.

True wealth doesn’t crave attention. Instead, it shows up quietly in your life. It looks like freedom, calm, and the confidence to survive when problems arise. As a result, chasing appearances keeps you stuck, while building real wealth gives you long-term freedom.

The Culture of Looking Rich

Modern culture glorifies appearances. Social feeds are full of curated lives, influencers showing new purchases, and friends upgrading cars or houses. Because of this constant exposure, the pressure to keep up feels unavoidable.

However, spending to look wealthy doesn’t make you wealthy. In fact, it often makes you weaker financially. For example:

- A £5,000 handbag might turn heads, but it doesn’t build assets.

- Leasing a sports car looks glamorous, but the debt behind it grows.

- Fine dining every week feels indulgent, yet it erodes your savings.

Therefore, chasing the look of wealth builds a fragile image. When an emergency hits—like job loss, rising rent, or a health issue—the illusion quickly crumbles.

Being Rich: What It Actually Means

Being rich vs looking rich is about outcomes, not optics. True wealth doesn’t show itself in labels or posts. Instead, it reveals itself through quiet strength and control.

Being rich means:

- Having an emergency fund ready for tough times.

- Investing regularly so your money grows while you sleep.

- Choosing work you enjoy without fearing every paycheck.

- Walking away from toxic situations without panic.

- Helping family or friends without breaking your budget.

- Sleeping peacefully, knowing you are secure.

In other words, being rich means having choices. It’s less about proving status to strangers and more about protecting your freedom.

Why People Chase the Illusion

If appearances are so shallow, why do so many still chase them? The reasons are emotional and cultural.

- Social Comparison – Humans compare by nature. When people around you upgrade, you feel pressure to follow.

- Instant Gratification – Flashy purchases create quick happiness. Sadly, the debt lasts much longer.

- Cultural Pressure – Adverts and media tie success to luxury brands. As a result, people link identity to consumption.

- Lifestyle Inflation – Every pay rise feels like permission to spend more. Savings rarely grow.

- FOMO (Fear of Missing Out) – Watching others enjoy luxuries convinces us that spending equals progress.

On the other hand, resisting these pressures helps you build real financial strength.

The Hidden Cost of Looking Rich

Looking rich has hidden costs that compound over time. While you might impress others for a moment, the damage to your finances lingers.

- Debt Grows – Loans, credit balances, and instalments pile up.

- Savings Disappear – Emergencies push you into deeper debt.

- Stress Builds – Pretending to be wealthy causes constant anxiety.

- Opportunities Vanish – Money spent on image could have been invested.

Therefore, looking rich doesn’t just fail to make you rich—it actively delays your freedom.

How to Break the Cycle

Escaping the illusion takes conscious effort. Here are steps that make the shift from looking rich to being rich possible:

1. Define Wealth on Your Terms

Wealth isn’t the same for everyone. For you, it might mean freedom, time with family, or security. For someone else, it might mean travel or early retirement. By deciding what wealth means to you, you create a compass that guides spending decisions.

2. Build Quietly

Real wealth doesn’t need applause. Save consistently, invest automatically, and let compounding do its work. Moreover, silence protects you from outside pressure and keeps your focus steady.

3. Use Social Media Carefully

Remember that feeds are highlight reels. People often post success but hide debt. Therefore, measuring your life against others online creates false pressure.

4. Save Before You Spend

Every time your income increases, upgrade savings first. Treat investments as mandatory, not optional. As a result, you protect your future before chasing upgrades.

5. Celebrate Quiet Wins

Clearing debt, finishing an emergency fund, or investing regularly are victories. Instead of sharing them for validation, enjoy the satisfaction privately.

From Illusion to Reality: The Power of Compounding

Looking rich gives short-term rewards—likes, admiration, maybe envy. Being rich gives long-term rewards—freedom, resilience, and independence.

Over time, the gap grows wider. The illusion fades as debt piles up, while real wealth compounds steadily. Those who choose reality enjoy peace of mind; those who chase appearances struggle to keep the mask intact.

A Tale of Two Friends

Picture Sarah and James. Both earn £50,000 each year.

- Sarah spends every raise on appearances. She buys designer fashion, upgrades her car, and books expensive holidays. She looks wealthy, but her bank balance stays empty.

- James takes a different path. He saves part of every raise and invests quietly. He avoids unnecessary upgrades.

After ten years, Sarah has debt and photos. James has assets, freedom, and security. This is the real difference between looking rich vs being rich.

Final Thought – Choose Lasting Wealth

Looking rich may impress strangers, but being rich gives you freedom. The Instagram lifestyle fades; real wealth endures. Don’t chase applause—choose control. Prove wealth by building it, not by talking about it. Focus less on appearances and more on investing in your future. Looking rich disappears quickly. Being rich lasts a lifetime. The choice is yours.

Watch: How to Stack Skills to £10k (Video)

This related video expands today’s theme: quiet execution beats loud intentions. It shows how talent stacking—combining a few simple skills with light automation turns focused action into results without burnout. Watch it first, then apply the Silent Strategy to build privately and let outcomes speak.

The Silent Strategy

Silence is not shyness; it is leverage. When you announce big goals, your brain often rewards you as if progress has been made. Consequently, motivation drops and follow-through suffers. This five-minute idea flips that pattern. Keep your aims private, protect your energy, and let the work—not the words—create momentum. Backed by behavioural research and timeless wisdom, the Silent Strategy shows why quiet execution compounds faster than public promises.

Instead of chasing applause, choose evidence. Build in the background, test in small loops, and reveal only results. Over time, this reduces outside noise, eliminates performative pressure, and strengthens focus. Ultimately, silence becomes a moat around your attention.

Stop Talking, Start Doing

We all love the buzz of saying, “I’m starting a business,” or “I’m going to lose weight.” Unfortunately, that quick hit of recognition tricks the brain into feeling done. Therefore, most resolutions fade before they start. The Silent Strategy replaces talk with traction: keep goals private, set tiny daily actions, and move the needle before anyone hears about it.

Begin with one clear commitment you can complete today. Next, repeat it tomorrow. Track real outputs pages written, leads contacted, workouts finished instead of declarations. As a result, you preserve drive, build proof, and let outcomes speak louder than plans.

Explore More Growth Playlists

Each blog isn’t just words — it’s a shift in mindset:

🧠 Believe and Become helps you rediscover who you really are beneath the doubt.

🎯 Believe and Visualization shows how to shape your future by rewiring your inner world.

🚀 Dream Big challenges you to expand your vision beyond your current limits.

🏗️ From Nothing to Empire shares how ordinary people turned pain into purpose.

🗣️ He Spoke It First reveals how your words can reshape your entire destiny.

💼 Learn and Earn gives you real-world digital skills to turn into income.

🔁 Miracle of Discipline teaches how tiny consistent habits create massive long-term wins.

⚡ Stop Thinking, Start Doing is your call to action if you’ve waited too long to start.

Each blog isn’t just a read — it’s a mindset shift.

From Silence to Scaling

Quiet focus is the foundation; scalable systems are the multiplier. At Nas Digital Growth, we help you turn ambition into action by aligning four pillars: a mindset that protects your attention, a strategy that bridges vision to execution, a system that converts skills into income, and a brand presence that grows while you stay consistent.

Move from private progress to public proof—on your terms. Design a lean offer, install simple automations, and publish only the milestones that matter. When your process runs quietly and your results speak for themselves, you don’t need louder goals; you need a smarter strategy.

🔗 Get Instant Access to the Free Video + Blog Series — Because your future shouldn’t be a headline, it should be the reality you quietly build.

If you’re ready to stop wasting energy on empty announcements—and start building quietly with results that speak for themselves—then Nas Digital Growth is your partner.

Because following got you stuck. Building sets you free.

Obedience Trained You. Now Ownership Sets You Free.

At Nas Digital, we stand by two life-changing truths:

A mindset that questions the system

And a skillset that builds beyond it

If you’re ready to stop trading time for money — and start building assets, freedom, and long-term value — it begins here. Download the free blueprint. Reach out to our team. Make the move that turns your paycheck mindset into a builder’s path.

🔗 Get the Free Guide Now

💬 Chat With Us on WhatsApp

You’ve heard the story. You’ve seen the blueprint. Now it’s your move.

You’ve heard the story. You’ve seen the blueprint. Now it’s your turn to lead. Join Nas Digital Growth. Learn the skills. Build the future. The empire you want already exists — you just need to start building. Learn. Build. Rise. Because being rejected isn’t the end.

Ready to Transform Your Life?

Get instant access to 100+ world-class programs, 1,000+ guided meditations, a global growth community, and an AI-guided path tailored just for you. Try Mindvalley risk-free for 15 days — no questions, no hassle.

You’ve heard the story. You’ve seen the blueprint. Now it’s your move.

You’ve heard the story. You’ve seen the blueprint. Now it’s your turn to lead. Join Nas Digital Growth. Learn the skills. Build the future. The empire you want already exists — you just need to start building. Learn. Build. Rise. Because being rejected isn’t the end.

Ready to Transform Your Life?

Get instant access to 100+ world-class programs, 1,000+ guided meditations, a global growth community, and an AI-guided path tailored just for you. Try Mindvalley risk-free for 15 days — no questions, no hassle.

Nas Digital Growth Blueprint

A powerful step-by-step system to build your brand, learn digital skills, and turn knowledge into income.

🔗 Get the Blueprint

Nas Digital Consultancy

Your expert partner for content, branding, web design, and growth marketing—designed to help you scale with confidence.

🔗 Explore Consultancy Services

🔗 Visit Our Official Website

FREE Done-For-You Business Blueprint

Get a plug-and-play plan to kickstart your online business—no guesswork, just results.

🔗 Claim Your Free Blueprint

Imagine $10K in 30 Days

Visualize it. Strategize it. Achieve it. This free tool helps you see what’s truly possible.

🔗 Try It Now

NDC Agency (UK-Based Consultancy Site)

Tailored digital solutions for UK, NZ, AU, and Irish businesses.

🔗 Visit NDC Agency

Mindvalley: Your Growth, Amplified

100+ world-class programs, guided meditations, and AI-personalized transformation—all in one platform.

RELATED POSTS

View all