Quiet Millionaire Habits · Part 2

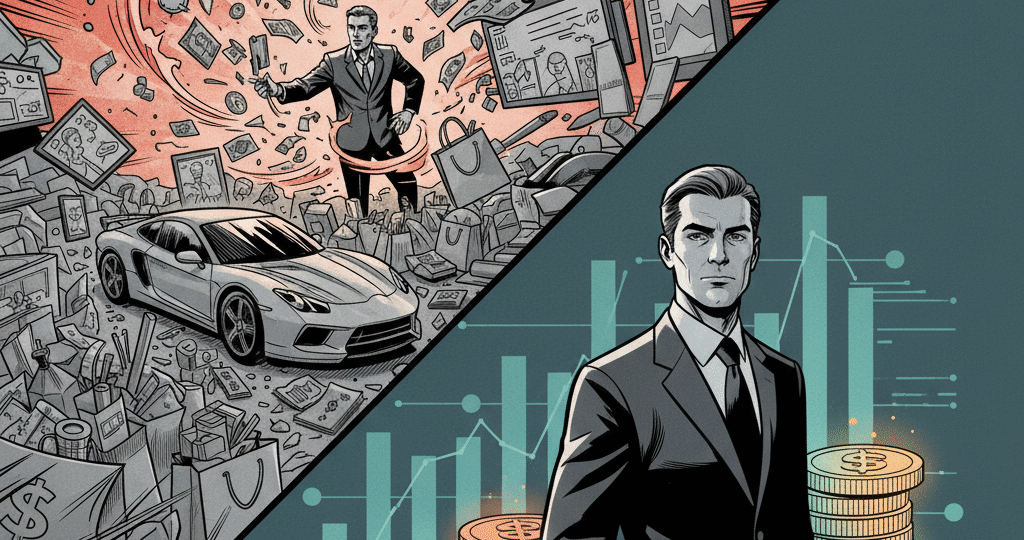

The 50/30/20 Formula That Makes You Rich Slowly (and Surely)

Wealth doesn’t appear in one giant leap — it grows through rhythm, structure, and patience. The 50/30/20 rule is the simple rhythm that quietly builds freedom. It tells your money where to go before the world does.

Why most people need a rule — not luck

Without boundaries, money evaporates. Expenses expand to fill income. The 50/30/20 rule creates calm — a repeatable pattern that ensures your needs are covered, your wants are contained, and your future is funded. It’s not a punishment plan; it’s a *permission plan* that balances life and long-term wealth.

What the 50/30/20 Formula Actually Means

At its core, it’s a budgeting compass. Every pound or dollar you earn has a direction:

- 50% → Needs: Housing, food, utilities, transport, insurance, healthcare — the non-negotiables that keep life stable.

- 30% → Wants: Lifestyle and leisure — dining out, streaming, gadgets, travel, hobbies. Enjoy them *within limits.*

- 20% → Investments: Assets that grow or pay you — index funds, pension, ISA/Roth contributions, skill development, or business capital.

The secret isn’t saving what’s left after spending — it’s spending what’s left after investing.

Why This Simple Split Works (When Others Fail)

Complexity kills consistency. The 50/30/20 rule thrives because it’s flexible, realistic, and automatic. You can apply it to any income level — the ratios scale up or down. The *percentage discipline* matters more than the numbers.

1 · Built-in awareness

You instantly see where every pound goes. Awareness converts chaos into control.

2 · Automatic saving behaviour

By ring-fencing 20%, you become an investor by default, not by mood.

3 · Stress-free spending

You enjoy life guilt-free because your plan already accounts for it.

When the Percentages Don’t Fit (Yet)

Maybe your rent alone eats 60%. That’s fine — this is a roadmap, not a law. Here’s how quiet millionaires adjust without quitting:

- Compress Wants: Freeze lifestyle upgrades until your needs shrink.

- Renegotiate Needs: Move, share, refinance, or switch suppliers to reduce fixed costs.

- Expand Income: Apply the “side-hustle lever” from Blog 1 — sell results, not hours.

Every 5% you reclaim from expenses accelerates compounding.

From Budgeting to Building Wealth

The “20%” is your growth engine. It’s where money stops being money and starts becoming freedom.

Invest in Assets

- Index funds / ETFs (broad, low-cost).

- Tax-advantaged accounts — ISA, Roth, 401(k).

- Dividend reinvestment — let income buy more income.

Invest in Skills

- Courses that raise your earning power.

- Tools that automate or multiply results.

- Mentorship or communities that sharpen strategy.

Invest in Systems

- Auto-transfers on payday.

- Separate accounts for needs, wants, investing.

- Weekly 15-minute money review habit.

Example Scenarios (UK Figures)

Here’s what it looks like in action:

- £2,000 net income → £1,000 needs · £600 wants · £400 invest.

- £3,500 net income → £1,750 needs · £1,050 wants · £700 invest.

- £5,000 net income → £2,500 needs · £1,500 wants · £1,000 invest.

Result: steady progress without deprivation or burnout.

Your 30-Day Implementation Checklist

- List monthly net income and fixed expenses.

- Tag every cost as need, want, or investment.

- Create three bank “pots” or digital wallets (50/30/20).

- Set standing orders for each category on payday.

- Track for four weeks; adjust percentages by ±5 % if needed.

- Automate the investing pot into your chosen asset or account.

- Schedule a 15-minute Friday review (wins, leaks, next tweak).

Common Mistakes to Avoid

Ignoring Irregular Expenses

Birthdays, car MOT, or holidays aren’t emergencies — plan them inside your “wants” pot.

Investing Before Killing Debt

High-interest debt cancels compounding gains. Clear it first.

Mixing Accounts

Keep your categories separate; clarity fuels consistency.

NDG Pro Tips

- Pair the 50/30/20 rule with **auto-investing** — you’ll never miss a deposit.

- Use a separate card for “wants” to stop impulse blending.

- Whenever you earn extra (raise, bonus, side gig), add **half to investments** before lifestyle creeps.

- Review your ratios every 6 months — freedom is built by iteration.

Turn Your Budget into a Wealth Engine

The 50/30/20 formula is the bridge between chaos and control. When paired with NDG’s automation system and side-income frameworks, it becomes the quiet millionaire’s foundation for freedom. Ready to master it with expert guidance and real-world tools?

Educational content only. Not financial advice. Investing and budgeting involve risk; results vary with consistency and discipline.